Simple depreciation calculator

Di indicates the depreciation in year i C indicates the original purchase price or. Di C Ri Where.

Declining Balance Depreciation Double Entry Bookkeeping

Step one - Calculate the depreciation charge by using below given formula Depreciation charge per year Asset value - Residual value x Depreciation percentage 3000 - 1000 x 15.

. Just enter the loan amount interest rate loan duration and start date into the Excel. Our car depreciation calculator uses the following values source. It is fairly simple to use.

Know at a glance your balance and interest payments on any loan with this simple loan calculator in Excel. Select the currency from the drop-down list optional Enter the purchase price of the vehicle Input the current age of the vehicle - if the car. Our macrs depreciation calculator uses the given macrs formula to perform macrs calcualtion.

Rental property depreciation calculator. The calculator allows you to use. See the results for Fixed asset depreciation calculator in Seattle.

We have created a. Straight line depreciation calculator. Period Period may be in Years Or Months.

The algorithm behind this straight line depreciation calculator uses the SLN formula as it is explained below. All you need to do is. Hence it is given the name as the diminishing balance method Depreciation Calculator Excel Template.

Based on Excel formulas for SYD. This calculator may be used to determine both new and used vehicle depreciation. Sum-of-Years Digits Depreciation Calculator Calculate depreciation for any chosen period and create a sum of years digits method depreciation schedule.

Periodic straight line depreciation Asset cost - Salvage value Useful life. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. Total Depreciation - The total amount of depreciation based upon the difference.

The MACRS Depreciation Calculator uses the following basic formula. Business vehicle depreciation calculator. The result shows how much the depreciation is anticipated to be in the first year and during the total.

After two years your cars value. It calculates the new depreciation based on that lower value. Simple growth 10 of 100.

Simple and Compound Calculator Appreciation Depreciation. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the. After a year your cars value decreases to 81 of the initial value.

Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. Depreciation Amount Asset Value x Annual Percentage Balance. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value.

How Simple Interest Works In This Calculator.

Straight Line Depreciation Formula And Excel Calculator

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Expense Double Entry Bookkeeping

What Is Straight Line Depreciation Method Pmp Exam Youtube

Straight Line Depreciation Formula Guide To Calculate Depreciation

Straight Line Depreciation Formula And Excel Calculator

Depreciation Formula Examples With Excel Template

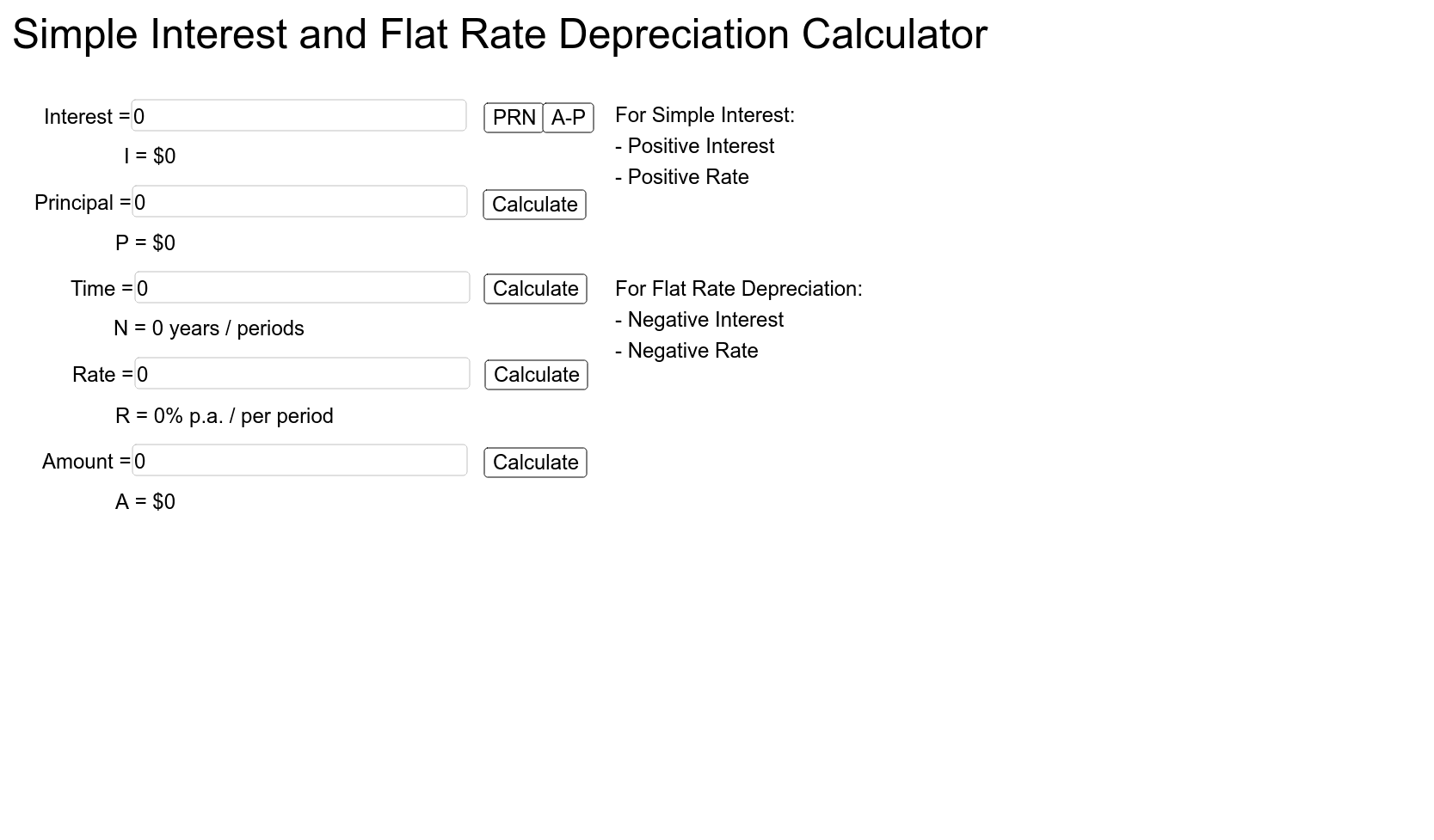

Simple Interest And Flat Rate Depreciation Calculator Geogebra

Straight Line Depreciation Tables Double Entry Bookkeeping

Double Declining Balance Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Double Declining Balance Depreciation Daily Business

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

Straight Line Depreciation Template Download Free Excel Template

Straight Line Depreciation Calculator Double Entry Bookkeeping

1 Free Straight Line Depreciation Calculator Embroker

Depreciation Formula Calculate Depreciation Expense